Australian broker ThinkMarkets, formerly ThinkForex of TF Global Markets, is located in Melbourne and London and is a global FX trading and financial service provider.

ThinkMarkets is one of the only brokers to allow high-speed automated trading, and it also offers clients up to 1 million dollars of insurance protection, which exceeds the industry standard.

Since its founding in 2010, the company has won many awards, including Best New Contributor at the Forex Best Awards in 2014. Unicef also named the company a Gold supporter of the Champion for Children. Through this program, ThinkMarkets makes a regular monthly contribution.

ThinkMarkets sounds amazing, but let’s find out more about the platform:

Top Features of ThinkMarkets.com

As a trusted, leading online forex and CFD provider, ThinkMarkets has a lot to offer platform users.

Top features include:

- Tight spreads, starting as low as one pip on EUR/USD, even under unstable market conditions.

- MT4 and MT5 platforms available on desktop and mobile.

- Over 12,000 tradable products, including cryptos, indices, forex, commodities, and more.

- Multilingual customer support available 24-hours, five days per week.

- It’s quick and easy to open an account.

- No requotes or slippage issues.

- Licensed in Australia and the United Kingdom.

ThinkMarkets allows customers to trade over 38 popular forex pairs, all with low spreads and non-desk dealing in a high-speed trading environment. Plus, there is no price manipulation because ThinkMarkets partners with Equinix to get information on the most current pricing data.

Trading options include CFDs on equity indices, energies, soft commodities, metals, alternative asset futures contracts, cash contracts, and gold and silver with competitive pricing. Trading CFDs gives traders access to global financial markets, all within the same account.

The ThinkMarkets Trade Manager is also a top feature. This app provides traders with an efficient way to manage trades using the MT4 platform. Users enjoy one-click execution, risk calculation, copying or executing trades on several accounts, and automatic trailing stops, partial closes, and hedges.

One of the only downsides of ThinkMarkets is that it has no binary options, but the broker makes up for the drawback with its many benefits and features.

ThinkMarkets.com Account Types

ThinkMarkets offers a demo account, two popular live trading accounts, and two alternative types of accounts.

Demo Account

A demo account is a great way to get to know the platforms and what the broker offers, as well as practice your trading skills in a risk-free environment. When you sign up for a free demo account, you can explore thousands of trading opportunities with $25,000 in virtual funds. You can also choose which platform you would like to trade on, including the popular ThinkTrader, MT4, and MT5.

Standard Account

Transition to a Standard account when you’re ready, with no minimum deposit and no commission. This account level allows you to trade with max leverage of 30:1, which means you get 30 times the buying power for your money. You’ll also have access to 500:1 leverage if you qualify as a professional trader.

Lot sizes are standard and customizable, depending on the size. The maximum trade size depends on the amount of margin you have available in your account. As a Standard account holder, you can choose from three trading platforms. You’ll also have access to free VPS hosting, which allows you to continue trading even when there are power or internet disruptions.

ThinkZero Account

ThinkZero is the company’s newest account offering and features lower spreads, tight commissions, and fast execution. A ThinkZero account offers zero to minimal spreads between the bid and asking price, which means you get direct access to institutional pricing without the broker’s added mark-ups. ThinkMarkets only charges a small commission.

The ThinkZero account is great for forex traders who want a low-cost option that allows them to calculate their costs precisely. Clients have the option to hold Standard and ThinkZero accounts simultaneously and transfer funds between the two. With a ThinkZero account, you’ll also have access to $1 million insurance protection, the next generation MT5 platform, and the Autochartist market scanner.

Islamic Account

In order to comply with Sharia law, ThinkMarkets provides an alternative, swap-free account to Islamic clients.

Joint Account

A joint account is offered to those who wish to open an account and share it with two or more individuals.

ThinkMarkets.com Spreads and Commissions

Average spreads on popular forex pairs generally start at 0.5 pips (EUR/USD) and 1.2 pips (GBP/USD). ThinkMarkets, however, scores highly in terms of trading fees, as their spreads start from zero pips.

ThinkZero spread accounts charge a 3.5 commission per side of 100,000. Traders are also charged commission when share trading on the ThinkTrader and MT5 platforms.

ThinkMarkets.com Leverage

Significant leverage is available to ThinkMarkets clients. Just make sure you have enough capital in your account to avoid a margin call. Leverage amounts include:

- Commodities – up to 1:200

- Cryptocurrency – up to 1:5

- Forex – up to 1:500

- Indices – up to 1:200

EU regulations state that the maximum leverage available to European traders is 1:30.

ThinkMarkets.com Deposits and Withdrawals

ThinkMarkets provide various ways you can deposit and withdraw, making managing your account from any location convenient and efficient. Payment methods available include:

- Bank transfer: AUD, USD, GBP, EUR, CHF (1-3 day processing time)

- Credit and debit card: AUD, USD, GBP, EUR, CHF (instant processing)

- Skrill: AUD, USD, GBP, EUR, CHF (10 minute processing time)

- Neteller: AUD, USD, GBP, JPY (10 minute processing time)

It’s important to note that both the deposit and withdrawal methods must be the same for security reasons. Normally, withdrawals are processed within a day’s time but may take up to a week in certain circumstances. The minimum withdrawal amount is 100 units of currency.

There is no minimum deposit with a Standard account, and there are no deposit or withdrawal fees at ThinkMarkets. A ThinkZero account requires a minimum deposit of 500 units of currency.

Users can check and manage their accounts through the broker’s secure ThinkPortal.

ThinkMarkets.com Customer Support

ThinkMarkets provides multilingual customer service 24 hours a day, five days a week, and can be contacted by email, telephone, and live chat (available on the website and mobile app). Additionally, ThinkMarkets offers a client portal, which provides a FAQ and online query form.

ThinkMarkets also manage social media profiles for those who want to keep up with the latest company news and views, or for anyone who wants to reach out via social channels.

Beginners and professionals alike will find a plethora of information in the ThinkMarkets’ collection of educational resources. Beginner, intermediate, and advanced trading tutorials are available, as well as articles, indicators and chart patterns, a trading glossary, trading guides, market news, technical analysis, webinars, blogs written by industry experts, and an updated economic calendar.

All of the tools and information is designed to help traders of all levels maximize their skills and minimize their losses.

ThinkMarkets.com Regulations

ThinkMarkets is a highly regulated, reliable broker. They offer negative balance protection so that clients don’t lose more than what they’ve deposited, and they provide $1 million in insurance protection.

TF Global Markets UK Limited is authorized and regulated by the FCA. The company is also the holder of Australian Financial Services License number 424700 and South Africa’s Authorised Financial Services Provider (FSP No 49835).

ThinkMarkets does not accept clients from the United States, Canada, Japan, and Belgium.

Final Thoughts

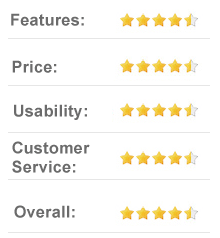

As an Australian company with many awards under its belt, ThinkMarkets is a suitable broker for forex and CFD trading, offering a multitude of trading platforms, thousands of trading instruments, and low spreads.

Novices and veteran traders alike will find valuable information, tools, and trading options at ThinkMarkets. The broker is highly regulated and trusted by customers worldwide.